Take control of your money with a 30 day no spend challenge printable.

In this fast-paced world, taking control of our spending habits is crucial for achieving financial goals and cultivating a healthier relationship with money.

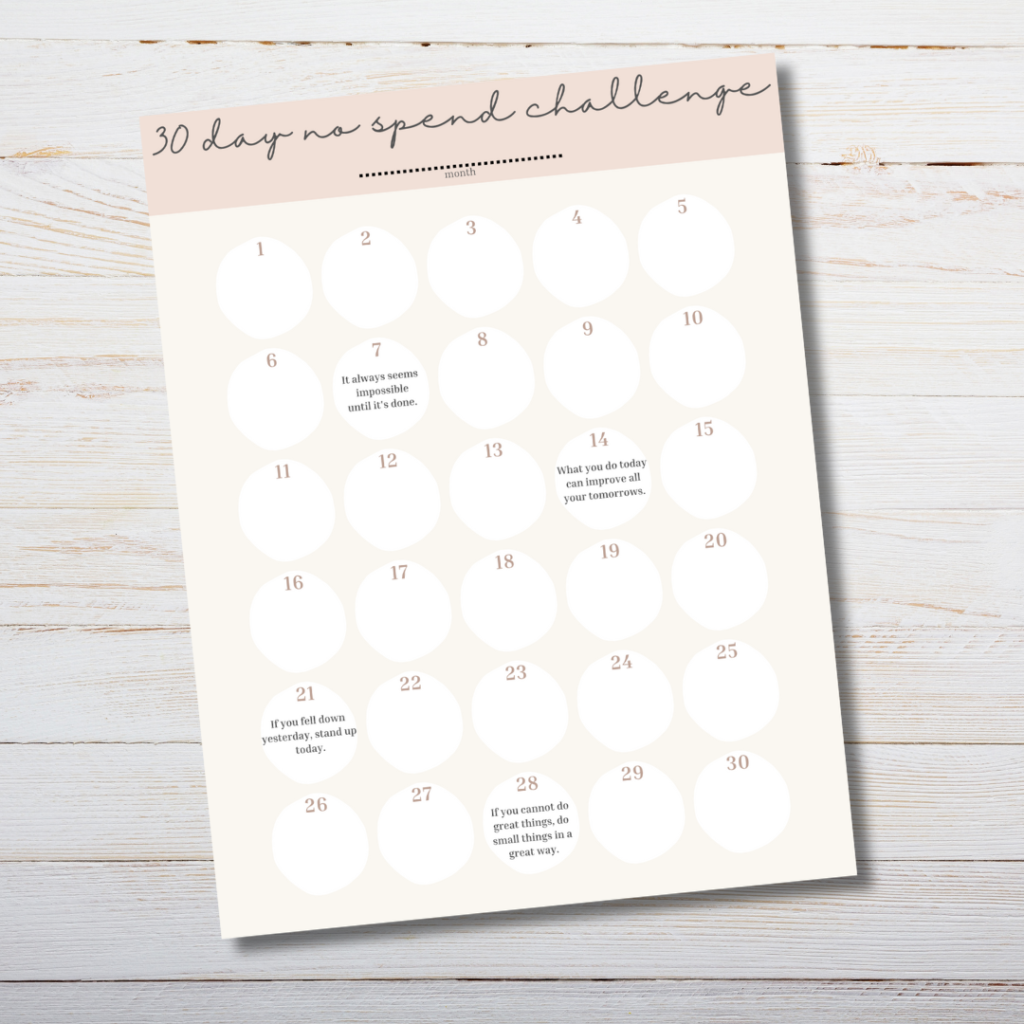

This printable is designed to guide you through a No Spend Month.

Embarking on a challenge can be a transformative experience for your financial journey, helping you gain control over spending habits, save money, and build a healthier relationship with your finances.

What is a 30 day no spend challenge?

A 30-day no spend challenge is a personal financial experiment where you commit to refraining from non-essential spending for a set period of time, typically lasting for an entire month, 30 days. The goal is to gain better control over finances, save money, and be more mindful about your spending habits.

During the challenge, participants consciously avoid unnecessary purchases, such as dining out, shopping for non-essential items, or engaging in activities that involve additional expenses.

The benefits of a no spend month challenge include increased financial awareness, improved budgeting skills, and the opportunity to save money. It’s a great way to identify and break impulsive spending habits, fostering a more intentional and mindful approach to money.

How to use a 30 day no spend challenge

Here’s a step-by-step guide on how to effectively use a 30-day no spend challenge:

Set Clear Goals:

Before starting the challenge, identify your financial goals. Whether you’re saving for a specific purchase, paying off debt, or just aiming for more mindful spending, having clear objectives will keep you motivated.

Create a Budget:

Take a closer look at your regular expenses and create a budget for the month. Differentiate between essential and non-essential spending to identify areas where you can cut back during the challenge.

Identify Non-Essential Spending:

Highlight areas of non-essential spending that you can temporarily eliminate during the challenge. This might include unnecessary items like dining out, entertainment, impulse purchases, or online shopping.

Use a 30-Day No Spend Challenge Printable:

Utilize a no spend challenge tracker to plan and monitor your progress. The printable design includes daily check-ins, goal-setting sections, and reflections to help you stay on track. Get the instant download of your own printable planner.

Plan Meals and Groceries:

Prepare a meal plan for the month and create a shopping list with only essential items. Avoid dining out or ordering takeout during the challenge to cut down on unnecessary expenses.

Avoid Non-Essential Purchases:

Commit to refraining from non-essential purchases for the entire duration of the challenge. This includes clothes, gadgets, home decor, and any items that are not critical to your basic needs.

Reflect Regularly:

Use the reflection sections in your printable to assess your progress regularly. Reflecting on your spending habits, challenges faced, and achievements will provide valuable insights into your relationship with money.

Stay Accountable:

Share your no spend challenge with friends or family who can help hold you accountable. Having a support system can make the challenge more enjoyable and increase your chances of success.

Find Free Alternatives:

Look for free activities that typically involve spending money. Opt for outdoor activities, explore local events, or engage in hobbies that don’t require financial investment.

Reward Yourself Mindfully:

Celebrate your achievements at the end of the month. However, be mindful of how you reward yourself. Consider non-material rewards or choose something that aligns with your financial goals.

Learn from the Experience:

At the end of the challenge, reflect on what you’ve learned about your spending habits and financial priorities. Use this knowledge to make more informed decisions about your future spending.

Carry Lessons Forward:

The 30-day no spend challenge is not just a temporary exercise; it’s an opportunity to instill lasting habits. Carry the lessons learned into your ongoing budgeting and spending practices for sustained financial well-being.

Remember, the key to a successful no spend challenge is commitment, self-awareness, and a positive mindset. Use the experience as a springboard for more mindful and intentional financial habits in the long run.

FAQs

What qualifies as non-essential spending during a no spend challenge?

Non-essential spending includes purchases that are not vital for daily living. This can encompass items like dining out, entertainment, clothing, gadgets, and other discretionary expenses. Essential spending, such as groceries, utilities, and rent or mortgage payments, is typically allowed.

How can I prepare for a no spend challenge?

Before starting a no spend challenge, it’s essential to create a budget, distinguishing between essential and non-essential expenses. Identify areas where you can cut back, set clear financial goals for the challenge, and plan for necessary expenditures.

Can I still pay bills and cover basic needs during a no spend challenge?

Absolutely. Essential spending, including bills, groceries, and other necessities, is generally allowed during a no spend challenge. The focus is on minimizing non-essential and discretionary spending.

What happens if I slip up and make an unplanned purchase during the challenge?

Slip-ups can happen, and it’s essential not to be too hard on yourself. Use it as an opportunity to learn about your spending triggers and refocus on your savings goals. The key is to be mindful of your choices and make adjustments as needed.

Due to the digital nature of this item (no physical product will be sent)t there are no refunds. Contains affiliate links as apart of the Amazon affiliate advertising program. For personal use only, not for commercial use.

Leave a Reply